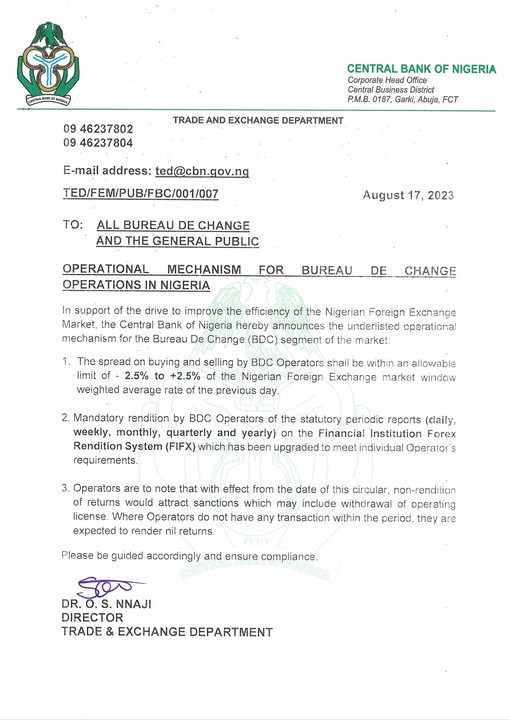

With the aim of boosting the operational efficiency of the Nigerian Foreign Exchange Market, the Central Bank of Nigeria (CBN) has introduced a series of operational adjustments for the Bureau De Change (BDC) sector.

The declaration, issued on August 17, 2023, presents a set of essential actions designed to simplify and enhance BDC operations.

According to the newly established framework, the margin between buying and selling rates maintained by BDC operators will now be limited to a range of -2.5% to +2.5% based on the previous day’s weighted average rate in the Nigerian Foreign Exchange market.

This strategic move is anticipated to bring about increased stability and transparency in the fluctuation of exchange rates, benefiting both BDC operators and the general public.

Another notable modification involves the obligatory submission of periodic financial reports by BDC operators.

These reports, spanning daily, weekly, monthly, quarterly, and yearly intervals, are required to be submitted through the upgraded Financial Institution Forex Rendition System (FIFX). This system has been tailored to meet the specific reporting requirements of each operator.

This adjustment seeks to heighten supervision and ensure that the BDC sector operates with enhanced responsibility.

The circular also highlights that failing to provide accurate reports within the stipulated timeframe will result in penalties, potentially leading to the revocation of operating licenses.

Even in situations where BDC operators have not conducted any transactions during a given period, they are still mandated to submit nil reports. This initiative promotes a culture of adherence to guidelines and meticulous record-keeping.

The directive calls on all BDC operators and the general public to familiarize themselves with these fresh directives and meticulously follow them.

Through the implementation of these measures, the Central Bank of Nigeria envisions a more resilient and well-regulated BDC sector that aligns with broader endeavors to heighten the efficiency of Nigeria’s foreign exchange market.

What this means:

Significantly, this action marks the reentry of BDCs into the country’s foreign exchange market.

This move stands in contrast to previous policies, including those enacted during the tenure of former CBN Governor Godwin Emefiele, which had temporarily excluded BDC operators from participating in the market.

This new policy underscores a concerted effort by the central bank to reengage BDC operators and reintegrate them into the foreign exchange landscape.